State of U.S. cable / MSO industry

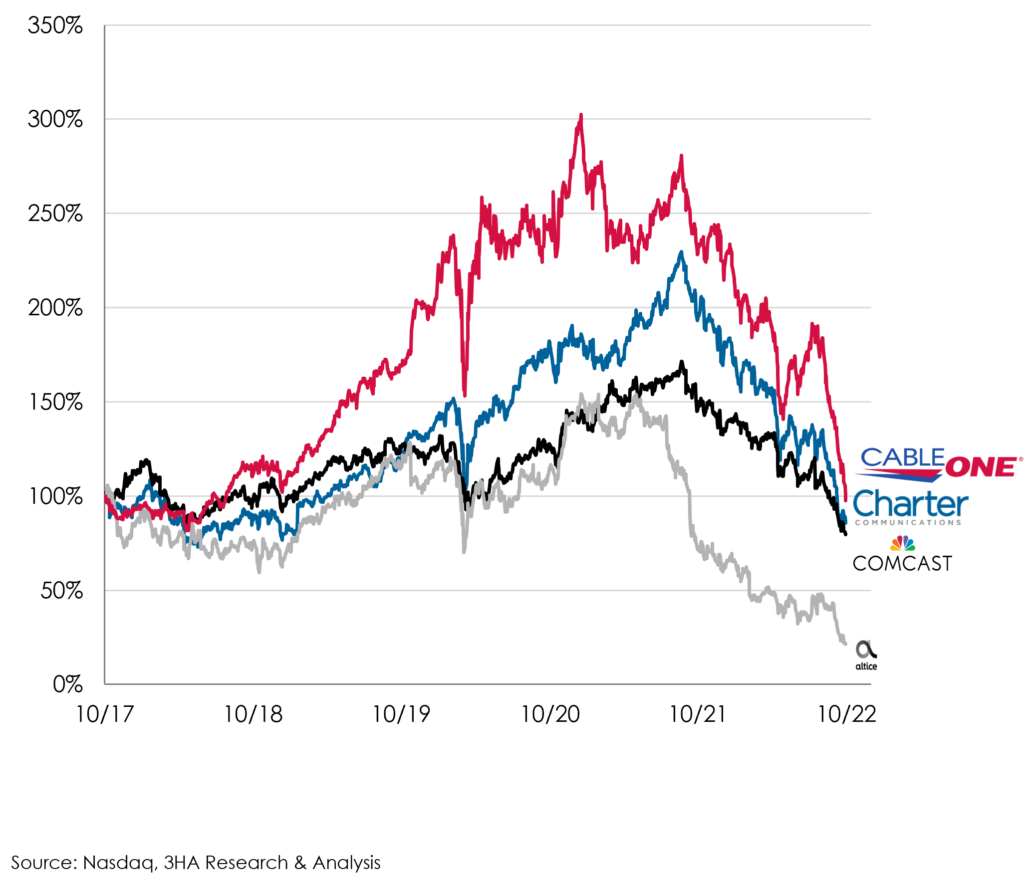

The cable industry has been battered of late, with the 3 largest cable stocks suffering massive declines from their highs in 2021. While obituaries have been written about these businesses, and the cord cutting continues unabated, we do not believe these companies are going to roll over.

This is part 2 of 3 and details the state of the U.S. cable industry and recent trends. Part 1 did the same for the wireless sector. And finally, in part 3, we do the head to head match-up with our proprietary analysis of revenue and profit pools each is chasing…

The following 7 charts should give you a bird’s eye view of where the industry stands today and where they might be headed:

1. Cable company stocks have been battered, with each declining between 54% and 86% from their post-COVID-19 highs

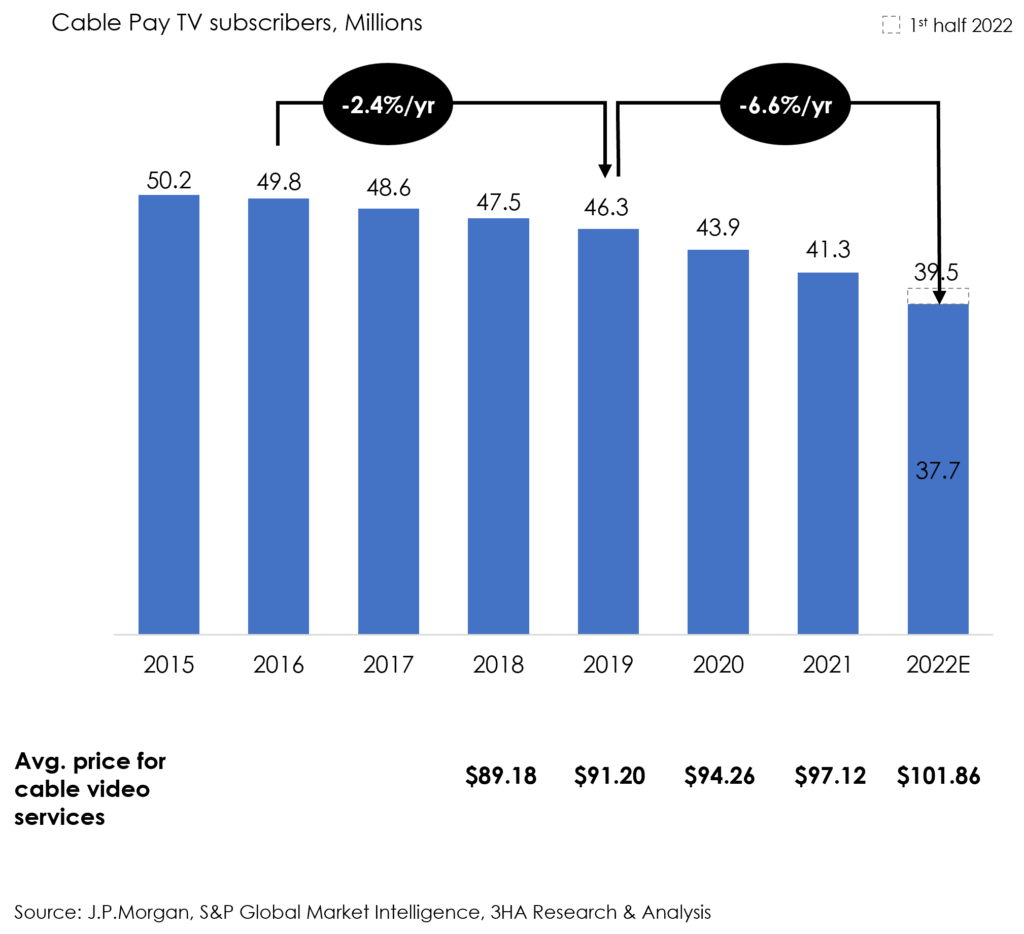

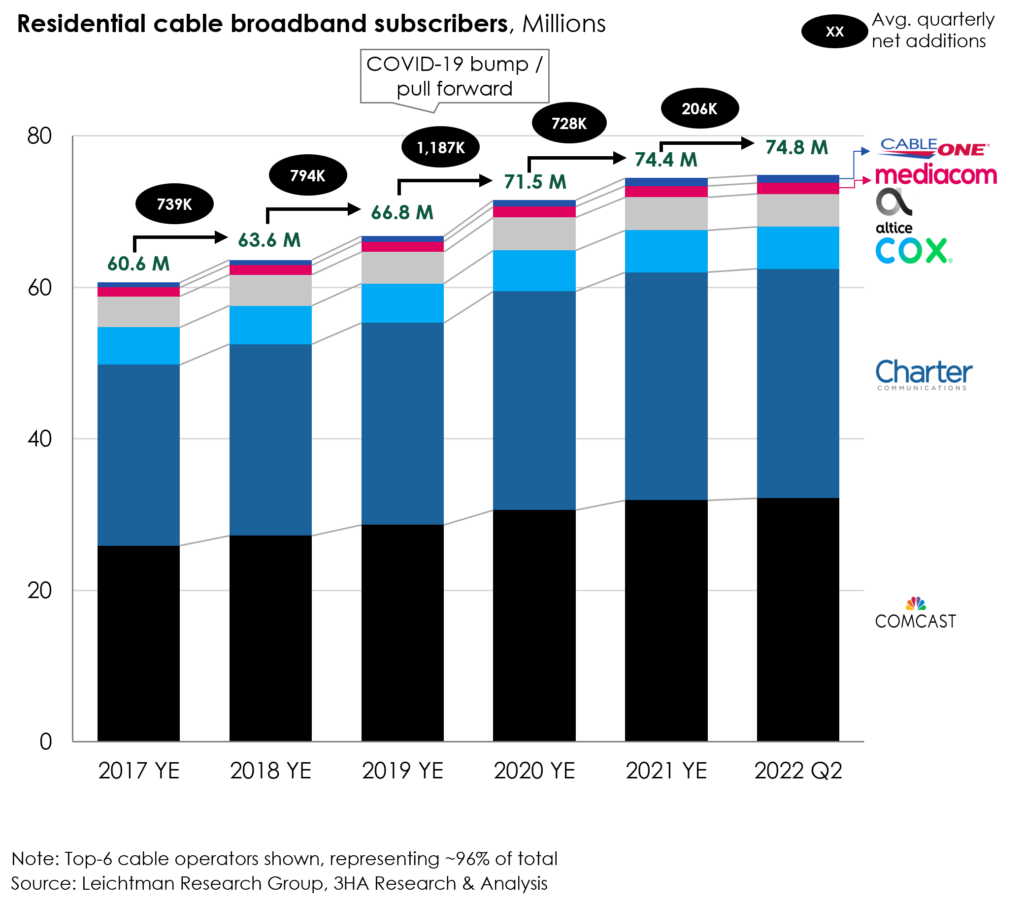

2. Cord cutting continues unabated and with the economy souring, only expect this trend to accelerate

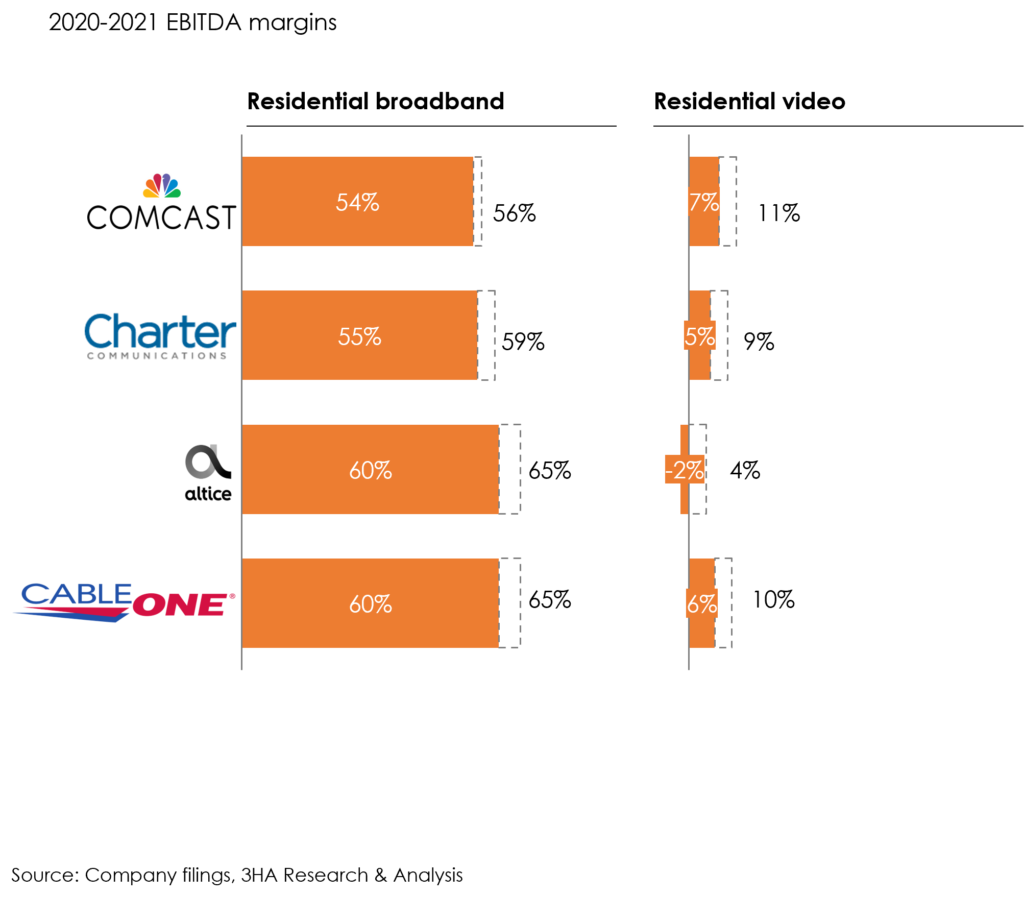

3. However, if there is any good news in this trend, linear TV has not been very profitable for MVPDs, especially with increasing costs

Related Read: Cable vs Telco

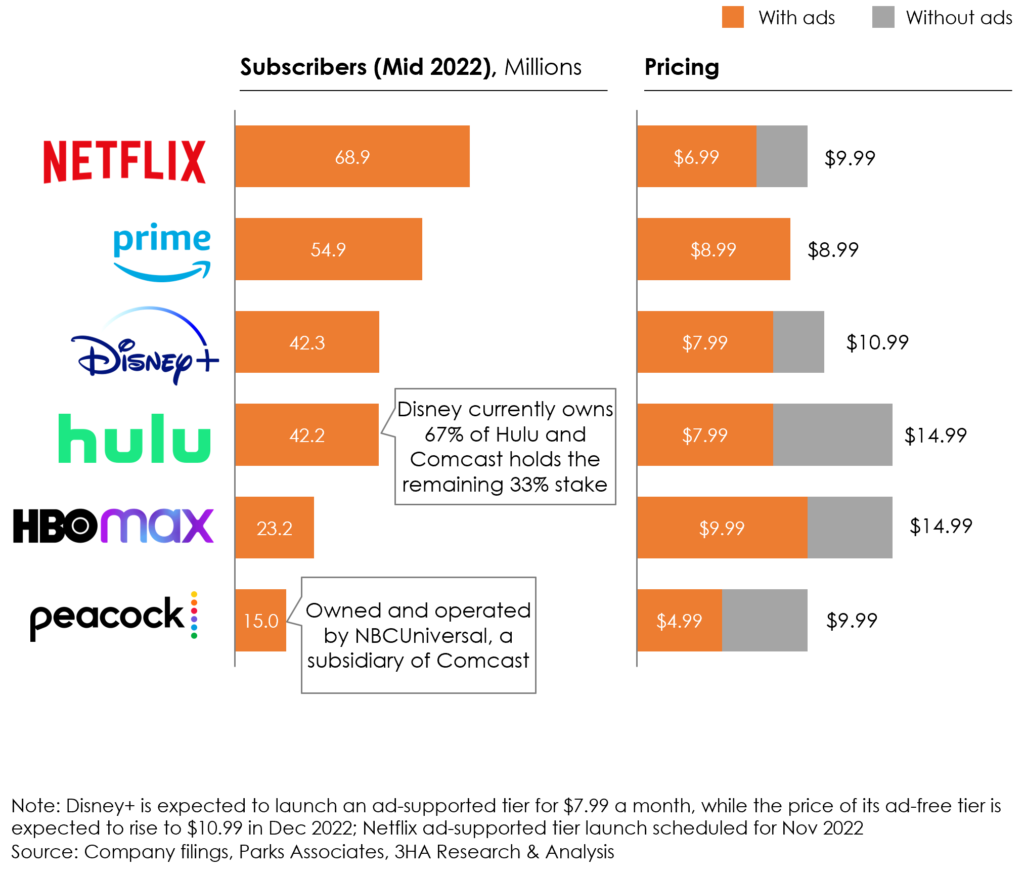

4. Cable companies’ pivot to vMVPD / streaming has been a mixed bag

5. Residential broadband, long the growth engine, has been sputtering of late – impacted by increased competition and the fact that organic footprint expansion, i.e., edge outs offers marginal economics

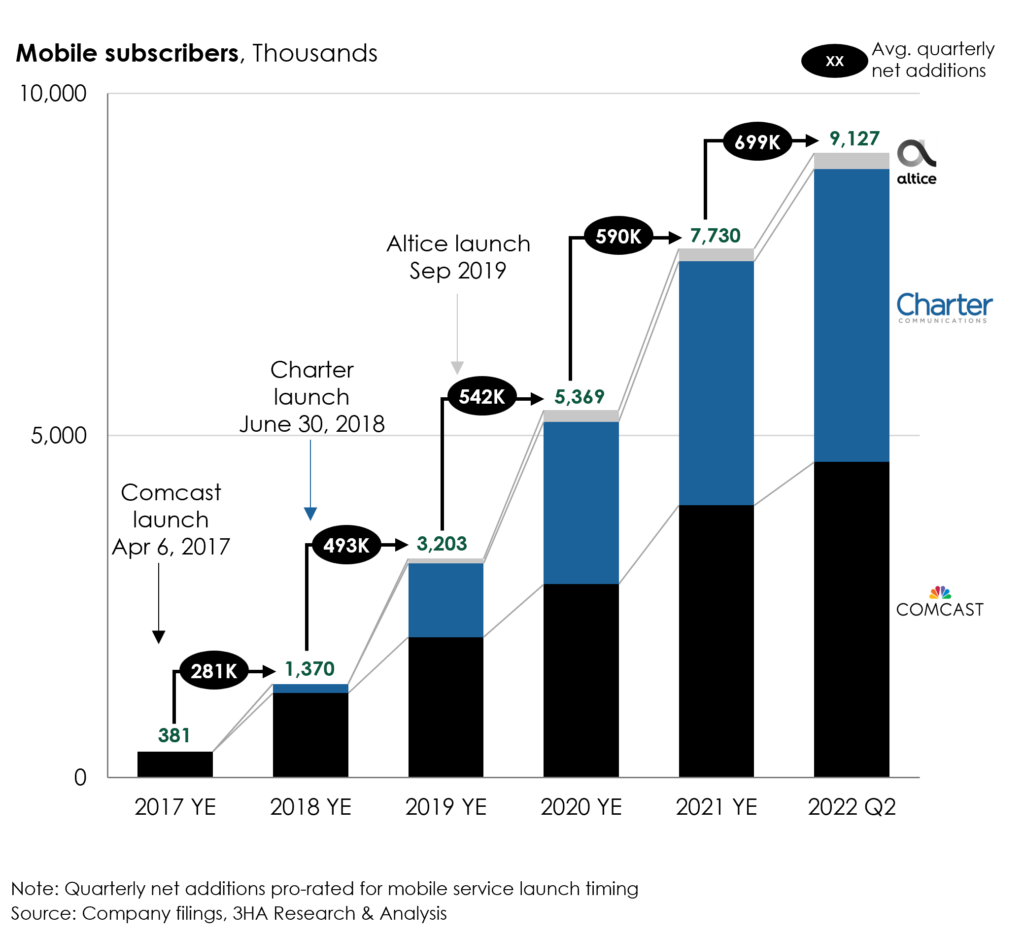

6. After multiple false-starts, cable has finally made wireless a key pillar of growth and early results are promising

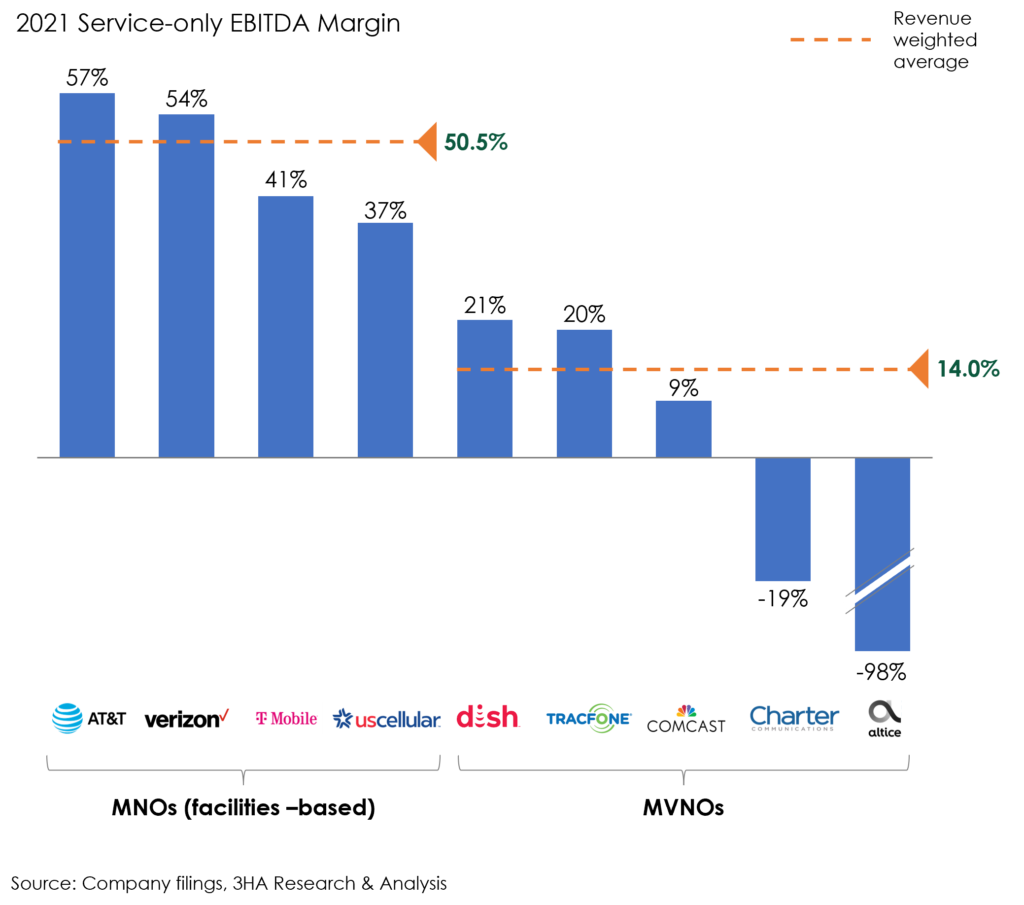

7. However, an MVNO model in wireless has never yielded sizeable profits

Where might they go from here?

- Ditch linear TV: It is no longer a sacred cow, and we ought to see these companies increasingly pivot to the virtual MVPD model and at the same time offer a bundle of streaming services including one they ‘own’ themselves

- Fight fiber with fiber: They are gearing up for war with telcos that are upgrading to fiber and disrupting the market with FWA. On one hand, this will mean making network upgrades themselves and on the other hand, pricing moves, either via a mobile bundle or longer-term contracts to ring fence their best customers

- Double-down on wireless: However, to address profitability issues with the MVNO model, we expect them to finally start rolling out localized networks to further offload traffic

Banner pic credit: Shirtoid.com