Approach: Assessing the odds of the T-Mobile-Sprint merger

Now that the biggest telecom news of 2018 has broken, and T-Mobile and Sprint have signed an agreement that eluded them for years, we were curious if we could handicap the odds of U.S. regulators approving the deal. It is easy to get excited about the prospects of the FCC clearing this merger since they declared in 2017, for the first time since 2009 that there was “effective competition” in the commercial mobile services market. This said, many regulatory bodies hold a veto in this matter, including the Department of Justice (DoJ) and the Federal Trade Commission (FTC) on antitrust grounds and CFIUS (Committee on Foreign Investment in the U.S.) on national security concerns. Despite expectations for reduced regulation with this administration, the DoJ is attempting to block a vertical merger for the first time in 4 decades with an antitrust case against an AT&T-Time Warner merger. CFIUS, which is an inter-agency panel that can recommend to the president to block deals, just earlier this year scuttled Broadcom’s attempt to acquire Qualcomm.

To properly handicap the approval and the two parties consummating a merger, one needs to understand the key factors the FCC, DoJ and FTC use to assess the impact of a proposed merger on competition, how concentrated the U.S. wireless market is to begin with, and how it has evolved over time, and how onerous any conditions could be if imposed on the merging entities. Judicious policy making by wireless regulators in the 2000’s laid the groundwork for the U.S. to wrest leadership in 4G and one would hope a similarly forward-looking and thoughtful approach would be employed to evaluate the effects of the proposed mega mergers in the telecom and media sectors as the industry begins the transition to 5G.

To this end, we will try and answer the following questions in order:

- Does the FCC’s declaration of effective competition in mobile services imply they are likely to bless the T-Mobile-Sprint combination?

- How do the DoJ and the FTC evaluate horizontal mergers?

- How concentrated is the U.S. wireless market and how has it evolved over time?

- What has increased competitive intensity in the wireless market done for consumers?

- How concentrated is the U.S. wireless market vs. other major markets around the globe?

Section 1: U.S. Mobile Services Industry Background

The U.S. is one of a select few countries categorized as a digital pioneer in 2017 by the GSMA for world leading adoption of the industry’s newest technologies, including 4G networks and smartphones. At the end of 2017, the U.S. had 105% SIM penetration and 92% of the connections had access to mobile broadband. This came after the U.S. had been a laggard in earlier generations of mobile technology, driven by missteps by both the industry with fragmented standards and the regulator, an egregious example of which was the requirement to keep analog networks operational even as the world transitioned to digital.

More recently, slowing wireless subscriber growth has increased the competitive intensity in the US wireless industry with disruptive pricing moves by all players. Furthermore, connected devices have started gaining traction, with 60%+ of new net additions for big-4 players in 2017 coming from non-phone devices (e.g. connected cars), but these connections also result in significantly lower ARPUs. In this environment, the wireless service revenues have remained static over the last several years, with 2017 revenues for the top-5 players at $177B being 4% lower than the industry’s 2013 revenues.

The US wireless industry is also experiencing several macro trends that are poised to bring significant change to the wireless market and its competitive landscape in the coming years. Key among them are:

- Unlimited Data: Since Sprint and T-Mobile disrupted the market, all major carriers have launched unlimited plans and with migration of legacy plans to unlimited, data consumption is expected to accelerate further

- Increased availability of unlicensed and shared spectrum: Unlicensed spectrum through WiFi carries approx. 70% of mobile traffic today and WiFi across multiple bands and LTE using CBRS shared spectrum expected to significantly augment in-building coverage and capacity which in turn would incent enterprises and others to launch relatively inexpensive but reliable private CBRS LTE networks

- 5G: All major carriers in the U.S. have announced plans to trial and rollout commercial 5G networks in 2019. Verizon is expected to approach the mobile and home internet markets in an integrated fashion. This leads to other participants to also invest heavily

- MSOs Re-enter Wireless: Cable companies pursue the mobile opportunity to respond to the 5G threat and are likely to focus on core video and home broadband customer retention. Comcast launched its wireless offering in 2017 enabled by a wholesale agreement with Verizon Wireless resulting from the SpectrumCo transaction for AWS licenses. After a slow start, the service has started to gain traction to end Q1 2018 with nearly 600K subscribers. Charter Spectrum is expected to launch their wireless offering later in 2018

- Horizontal and Vertical Mergers: Most sub-scale operators have been consolidated in the past 5+ years. Additionally, industry leaders are attempting to drive revenue growth by expanding into new verticals, such as the Oath business unit at Verizon to monetize advertising and DirecTV and Time Warner acquisitions by AT&T

Section 2: FCC’s 2017 Assessment of the U.S. Mobile Services Market

In Feb 2018, the FCC reiterated that closing the digital divide and furthering the deployment of advanced telecom capabilities remains their top priority. This taken in the context of ongoing development and impending deployment of 5G networks can be interpreted as supportive of any transaction that will continue to foster investments and innovation, even if price declines taper off.

The current FCC deviated from the approach in place since 2010 to address whether there was effective competition in commercial mobile services by narrowing the scope of inquiry and being more definitive with its findings. Earlier reports had attempted to examine the broader “mobile wireless ecosystem,” rather than just the participants in the provision of mobile wireless services and in doing so, found the landscape too complex and hence did not share a definitive finding on the presence of effective competition between 2010 and 2016. There are pros and cons to this revised approach as it pertains to the assessment of the impact of the proposed T-Mobile-Sprint merger. While the FCC’s recent assessment of the wireless industry and service providers led to the conclusion that there was effective competition in the industry now, the same narrow definition of the market will likely not do justice to the evolving landscape and technology and the resulting blurring of lines between wireline, wireless and video.

The FCC employs the widely used HHI (Herfindahl-Hirschman Index) to measure mobile wireless concentration. Based on its methodology, it determined that at year-end 2016, the weighted average HHI for mobile wireless services was 3,101. While this metric by itself would indicate a highly concentrated market with potential harm to consumers and other value chain participants, the FCC concluded the mobile wireless service market to have effective competition. This is because, it rightly considered other factors, including pricing trends, non-price rivalry, operator investment and innovation trends to evaluate the competitiveness in this market and found substantial evidence that the market had vibrant competition and continued to drive significant amounts of consumer benefit and surplus.

Key findings cited by the FCC to support the assessment of effective competition include:

- Falling prices: ARPUs declining by 7% YoY and price per MB decline continues unabated, having declined 99.7% between 2007 and 2017

- Greater investment: Since 2010, wireless service providers have invested nearly $250B resulting in 96.6% of Americans having a choice of 3 or more 4G LTE service providers

- Higher quality of service: Robust increase of 63% in LTE speeds since 2014 (through YE 2016)

- Greater innovation: Robust competition in developing and deploying innovative technologies including rapid expansion of LTE coverage, upgrades to LTE networks alongside 5G trials by all major operators

While hard to prognosticate how these metrics will evolve over time with 3 nationwide networks, there are indicators to guide this assessment:

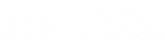

Spectrum holdings: The combined entity will lead the market in overall spectrum holdings with approx. 310 MHz population-weighted average holdings across the U.S. An FCC review is triggered if a transaction results in ownership of more than 1/3rd of the total spectrum in any market. Since the merged entity will hold less than 1/3rd of low and mid-band spectrum (<1GHz and 1-2GHz respectively) in most markets, it is unlikely this transaction will trigger a divestiture of significant amount of spectrum. As shown in Figure 1, with a combined subscriber base of 126M at the end of 2017, the merged entity will have 2.2x spectrum per subscriber as AT&T and 3.3x as much as Verizon. Historically, market leaders on this metric, with significant fallow capacity have competed aggressively on price and so one can expect price-based competition to continue

Figure 1: 2017 Year-end average spectrum per sub-MHz spectrum (<6GHz) per million subs

Note: Includes undeployed spectrum; Spectrum/sub does not account for spectral efficiency or coverage variances across bands

Sources: FCC, FierceWireless

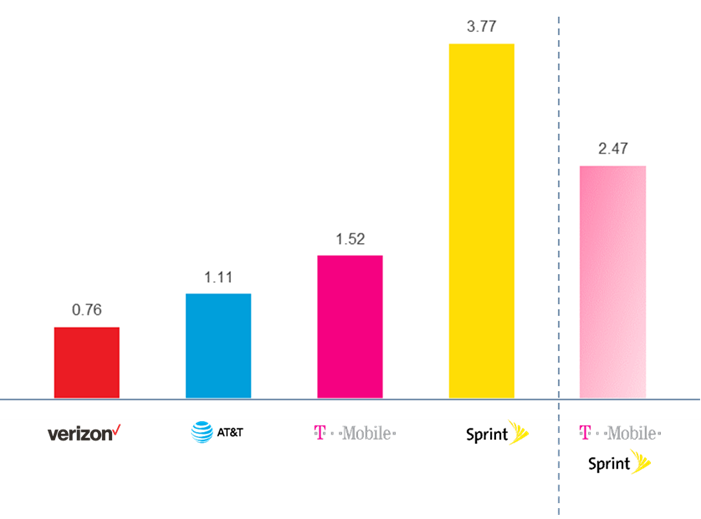

Capital investments: While all network operators have significantly improved peak download speeds as shown in Figure 2, T Mobile has made significant inroads into Verizon’s premium network claim by expanding coverage and capacity. This has been enabled by significant investments in both spectrum and network infrastructure. The combination with Sprint with access to “5G spectrum” offers them an opportunity to leapfrog the market leaders in 5G deployment and reaccelerate market share gains.

Figure 2: Average LTE download speed Mbps

Source: OpenSignal

This said, one thing that will surely happen post-merger is a significant increase in industry concentration as measured by HHI, deeper into the highly concentrated territory. This will make it that much harder for the FCC to continue supporting its assessment of effective competition in the mobile wireless service industry.

Section 3: DOJ and FTC Assessment and Likelihood of a Challenge

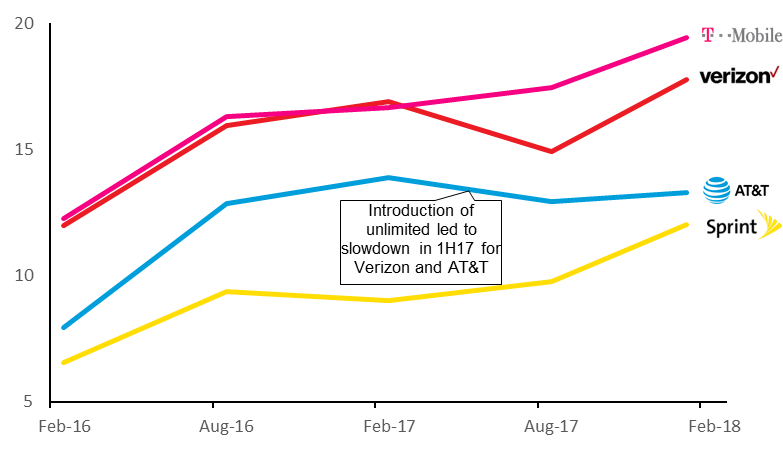

While the current FCC seems to have used a broad spectrum of factors in assessing competitive intensity in the industry, the DoJ and FTC’s assessment of merger proposals have historically been more formulaic. As detailed in the horizontal merger guidelines issued in August 2010, the DoJ and FTC employ a methodical and time-consuming approach to analyze the impact on the entire value chain and seek extensive data and input from the merging entities as well as other market participants. Critical to their analysis is the use of the HHI, associated thresholds that would trigger a challenge and the market definition they employ. To determine the likelihood of a challenge to this merger proposal, let’s understand each one of these as well as other ancillary factors in detail.

- Market Definition: As discussed earlier, the FCC in their most recent report on competitiveness in the mobile wireless market, used a traditional, yet narrow definition to include only the providers of mobile wireless services. They describe participants as both facilities-based service providers, including nationwide as well as regional and local providers as well as MVNOs and resellers, those that resell services purchased wholesale from the facilities-based operators. Yet, reconstructing their HHI of 3,101 leads one to believe their operative market for this analysis was narrower still. Unless the DoJ uses a broader definition to include the non-facilities-based players as well as potential entrants that could offer equivalent services, the assessment is likely to lead the department to conclude that there is not enough competition today and this will only get worse if the proposed merger is approved

- Market participants: In Q4 2017, the facilities-based service providers added approx. 2.3M postpaid smartphone subscribers, the most attractive type of customer. In comparison, Comcast a recently launched MVNO added 196K mobile subscribers in the most recent quarter, or approx. 8% of net additions. One would expect this to increase as they expand distribution across their network and offer more attractive bundles with broadband and TV services. Additionally, Charter the 2nd largest MSO is gearing up to launch its own mobile service and it is not hard to imagine that soon, this group of competitors would siphon off sizeable share of the most attractive customers from incumbents. To appropriately assess the impact of this competitive threat, one also needs to consider that these providers are non-facilities based and buy capacity wholesale from the incumbents. In the long run, they will not only derive margins significantly lower than incumbents, but in turn drive accretive business back to the incumbents

- Unilateral and coordinated effects post-merger: The DoJ will assess how differentiated the mobile wireless service offering is and the presence of substitutes. Unless the department believes in the convergence of fixed and mobile networks on one hand and connectivity and media on the other, they are likely to conclude that the merger will contribute is substantial lessening of competition. From their stance in the AT&T-Time Warner merger proposal, we can deduce that the department is unlikely to subscribe to the theory of blurring of competitive lines. This said, the department is not likely to make the argument that post-merger, coordination between firms is likely to increase

- Upstream value chain participants: Suppliers to U.S. wireless operators including independent tower companies, infrastructure OEMs and handset vendors have all undergone massive consolidation in the past decade. We currently only have 3 viable nationwide tower companies (American Tower, Crown Castle, and SBA), 2 network infra providers (Ericsson and Nokia due in part to the barring of Chinese vendors Huawei and ZTE from supplying U.S. telecom companies) and 2 handset vendors (Apple and Samsung). Therefore, the department is unlikely to make the argument that the proposed merger will harm upstream participants

- Market concentration: The U.S. Department of Justice considers a market with an HHI of less than 1,500 to be competitive, an HHI of 1,500 to 2,500 to be moderately concentrated, and an HHI of 2,500 or greater to be highly concentrated. As shown in Figure 3, the department uses a set of thresholds to determine whether to challenge a proposed merger.

Figure 3: DOJ and FTC guideline for assessing market concentration and challenging merger proposals

Using a methodology and market definition like the FCC, the merger of T Mobile-Sprint will result in a HHI increase of over 400 points for the mobile wireless market to approx. 3,250. This would lead the department to conclude enhanced market power for participants and will most likely result in a challenge.

In calculating market concentration post-merger, the DoJ and FTC use projected market shares. The merging parties could make the argument that MVNOs ought to be considered as viable industry participants and furthermore, they could offer wholesale agreements with terms far more favorable than Verizon, which in turn might lead to greater share gains for the MVNOs and result in a more sanguine view of increased concentration.

Section 4: Evolution of U.S. Mobile Services Competitive Landscape and Consumer Impact

Trying to define a market and determine its future evolution, especially competitive concentration is fraught with methodological problems. We will take a leaf out of the FCC’s book and try to assess the past, current and likely future for this market. The appropriate way to define a market is to consider 3 key dimensions – Cost, Customer and Competitor. Let’s take these in sequence:

Cost: The wireless industry is characterized by extremely high-fixed costs, be it for license and spectrum acquisition or to roll out networks or to acquire customers. Therefore, industry participants focus maniacally on scale to drive unit costs down. Most of the major costs are driven by the number of subscribers an operator serves. This is evidenced by the fact that operators in emerging markets like India and Indonesia generate EBITDA margins comparable to developed markets, even though their customer ARPUs are a fraction that of operators in developed markets. Though they have significantly lower revenue scale, subscriber scale enables them to achieve these margins. Hence it is reasonable to use subscriber count as the basis for calculating market concentration.

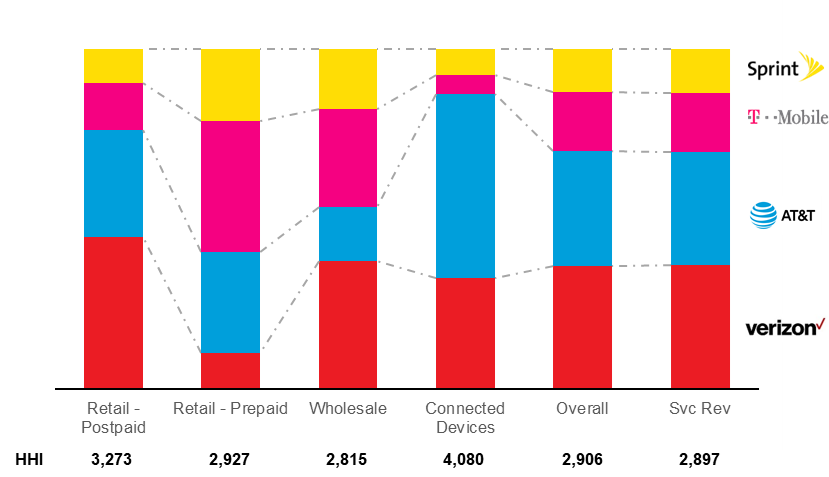

Customer: U.S. operators generally track their customers in 4 distinct segments – retail postpaid, historically the most profitable segment; retail prepaid; wholesale and connected devices, the last segment characterized by significantly lower ARPUs. There are marked differences in market share across operators in each one of these segments and one could argue that there are meaningful differences in costs to serve each one of these segments as well. Figure 4 shows the subscriber market share across each of these segments, overall subscriber and service revenue market share and resulting HHI for the nation-wide operators.

Figure 4: Subscriber share – Segment-wise and overall, service revenue market share and market concentration (HHI)

Note: Calculating HHI based only on 4 leading operators overstates industry concentration – E.g., including US Cellular alone reduces overall subscriber and service revenue HHI by ~100 points

Sources: FierceWireless, Wireless operator filings; FCC

It is evident that the market leaders, Verizon and AT&T have a significantly greater subscriber share in the postpaid business as well as in the emerging market for connected devices. The weaker showing for the #3 and #4 players in postpaid is a direct result of the historically weaker quality of networks as well as inadequate focus on the enterprise segment. One could argue the combined entity would be able to address both these issues expeditiously. With respect to connected devices, T Mobile and Sprint have had to focus on gaining subscribers in the existing and highly profitable segments and arrest weak performance respectively and hence have not been able to focus on the new segment adequately. A merger of this magnitude and resulting post-merger efforts may allow the market leaders to further cement their leadership in the connected devices segment.

It is interesting to note when considering overall subscriber counts or service revenues, the market concentration is comparable and in general look a little less concentrated than the individual (and artificially constructed one might add) segments. The critical question is how these market shares are likely to evolve to post-merger and how this would impact the market concentration.

Competition: MSOs and to a lesser extent MVNOs are likely to be the only meaningful competition to offer wireless connectivity to existing customer segments. Barring investment to build a 5th nation-wide network either by themselves or in partnership with someone like Dish, MSOs must rely on one of the facilities-based operators to properly address the market for connectivity. However, their ongoing investments in fiber and resulting ability to build dense small cell networks in urban areas and future access to unlicensed and shared spectrum could in time reduce their dependence on these operators a great deal. New entrants to the space such as technology companies enabling autonomous vehicles or drone commerce will likely depend on one of the existing operators or a small set of new players with access to spectrum and / or cell sites for reliable and low-latency connectivity. Even if these players do not build a competing network, they’ll likely be able to offer end customers an option for connectivity and so incumbents will be relegated to providing wholesale network services and could increasingly become disintermediated from the customer.

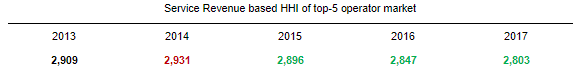

Recent evolution of competitive landscape: As we all have experienced, T Mobile with its Un-carrier initiatives since March 2013 has had great success in disrupting the wireless industry and has forced the hand of market leaders to compete head-on with aggressive pricing as well as unlimited product offerings. Even before T Mobile started disrupting the industry, wireless service pricing was declining. For example, between Dec 2009 and Sep 2015, while the overall CPI increased approx. 10%, the wireless service pricing declined 13%. Since then and with the launch of unlimited plans by all major operators, wireless plan pricing has declined a further 13%. Prices have continued to decline even as the industry has continued to consolidate. Wireless is one of the rare industries where unit prices have declined while consumption has increased. This has resulted in massive amounts of consumer surplus, and based on analysis by Recon Analytics, surplus has increased by almost $200B in the last 2 years alone. To the degree HHI is indicative of competitive intensity in the wireless industry, it has declined since 2012 as shown in Figure 5. This has been driven entirely by the market share gains T Mobile has made since 2012, primarily at the expense of Sprint and secondarily, Verizon. If T Mobile can convince the regulators that it will maintain its maverick ways and look to gain share at the expense of the market leaders, that could allay some of their concerns.

Figure 5: HHI trend for wireless services

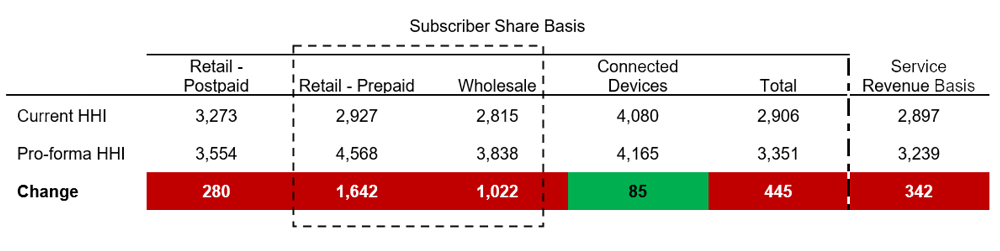

Pro-forma industry concentration: Large scale mergers in any industry, especially in the telecom sector have been notoriously difficult to execute. Case in point being the decade long struggles and downward slide at Sprint post the acquisition of Nextel Communications. Further complicating this task is the constantly evolving technological landscape. The appropriate approach is to develop a range of discrete outcomes and employ sensitivity analysis to model potential regulatory pre-conditions or competitor responses. However, we will approach the evolution of market concentration with a static analysis – i.e., assume there is no meaningful market share change leading up to, during and immediately post-merger of T Mobile and Sprint. We believe this is an extremely conservative approach as an extended merger review process and post-merger integration will not only impact the operational execution of the merging entities, but also heighten competitive activity. Moreover, the presence of multi-regional, regional and local facilities-based providers combined with the entry of resellers and MVNOs makes this market more competitive. However, to determine the change in market concentration, the 4-carrier analysis ought to be indicative.

Figure 6: T Mobile-Sprint merger – potential impact on industry competitive intensity

As expected, and as shown in Figure 6, prepaid and wholesale segments, where T Mobile and Sprint each have outsized market share become far more concentrated. In the other two segments, the merged entity might in fact be able to better compete with the market leaders and it wouldn’t be surprising to see the competitive concentration decline in due course. The magnitude of change will lead regulatory authorities to challenge the merger and / or impose significant conditions on the merger to address competitiveness in these segments.

Section 5: Mobile Services Competitive Intensity Across Major Global Markets

While the telecom sector in the U.S. has been consolidating for over a decade and by most measures is highly concentrated, it would be instructive to analyze the telecom market concentration across the globe, the correlation of market concentration to wireless prices on one hand and investment and innovation by operators on the other and finally, how regulators have fared in their attempts to foster competition.

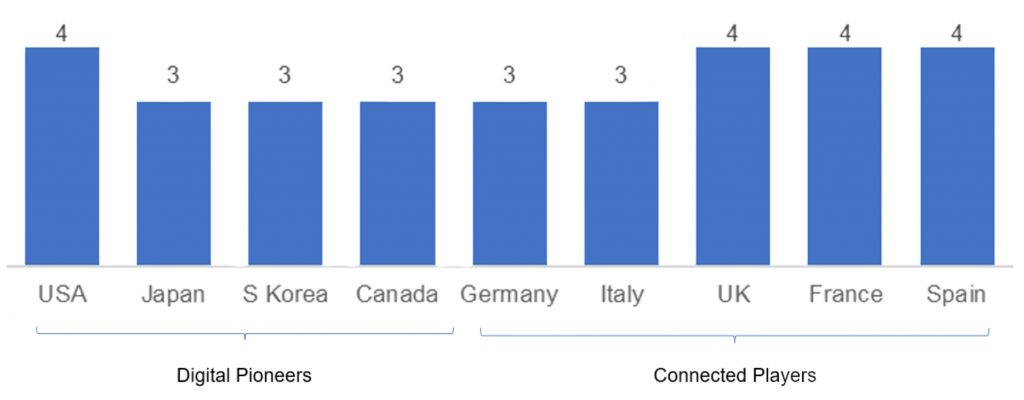

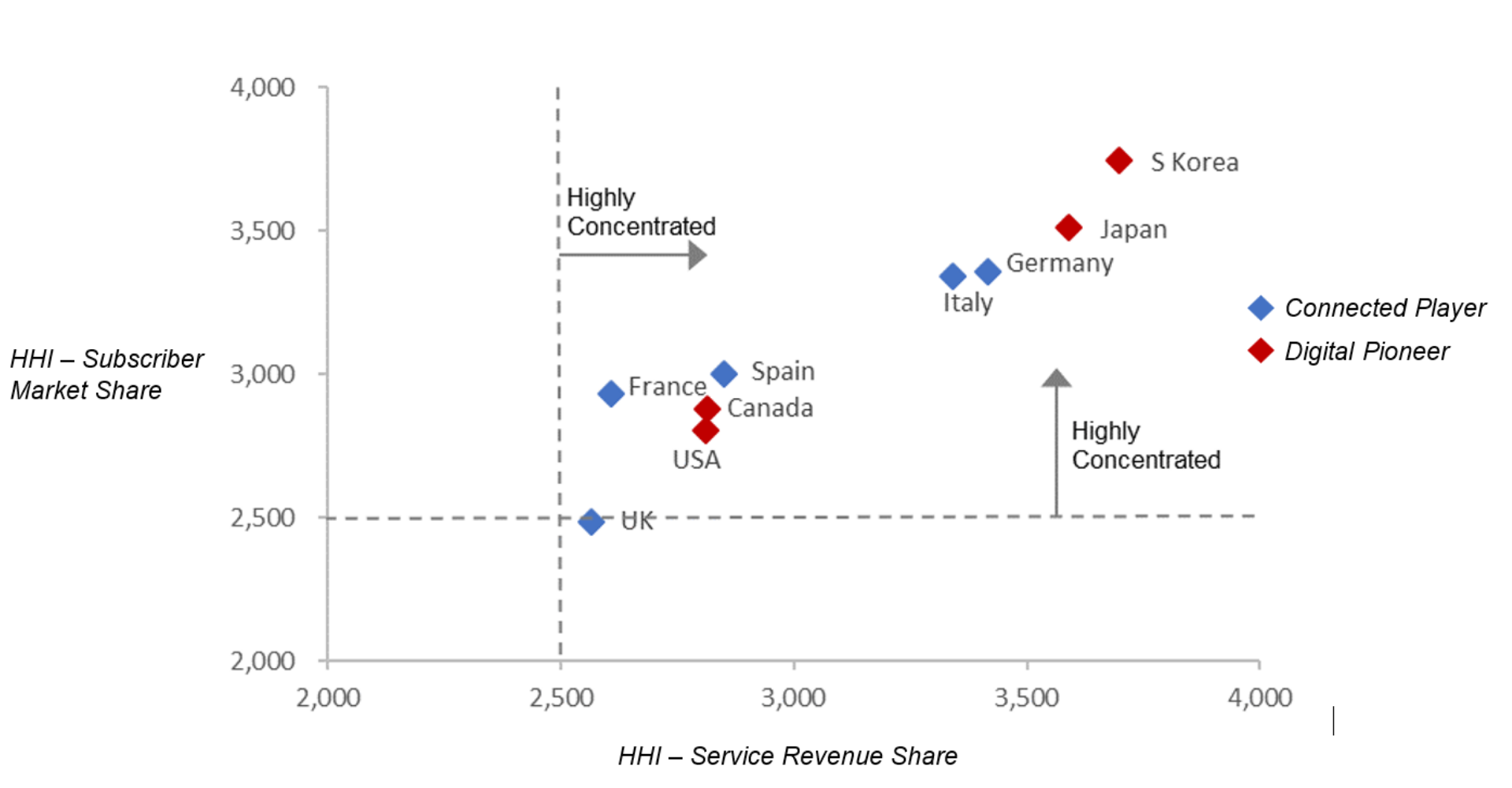

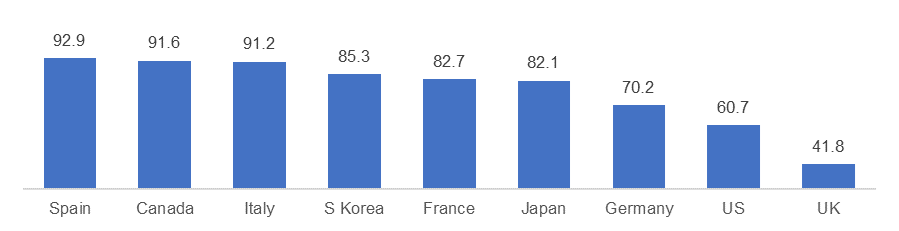

For this analysis, we compare 9 high-income countries across the three major regions of Americas, Europe and Asia Pacific. These countries are also among the top-30 globally in terms of total number of subscribers and generally seen as advanced in the deployment and use of wireless technology. As shown in Figure 7, all these countries have either 3 or 4 nationwide wireless networks, implying the wireless industry is highly concentrated across the globe.

Figure 7: Number of nationwide wireless operators

Note: Countries categorized as Digital Pioneers or Connected Players by GSMA Intelligence based on adoption rates of advanced technologies, i.e., 4G networks and smartphones

Number of industry participants vs. industry concentration: Though the number of nation-wide operators across these markets are similar, the industry concentration and competitive intensity across these markets are quite different. Among other factors, historical market share distribution within each market and operator’s varying growth and investment posture drive these differences. The market concentration (HHI) for these nine markets based both on subscriber and service revenue market share is shown in Figure 8. This analysis indicates that the wireless services market is highly concentrated in all major global markets and the U.S. market is among the least concentrated now.

Figure 8: Market concentration (HHI) based on revenue and subscriber market share

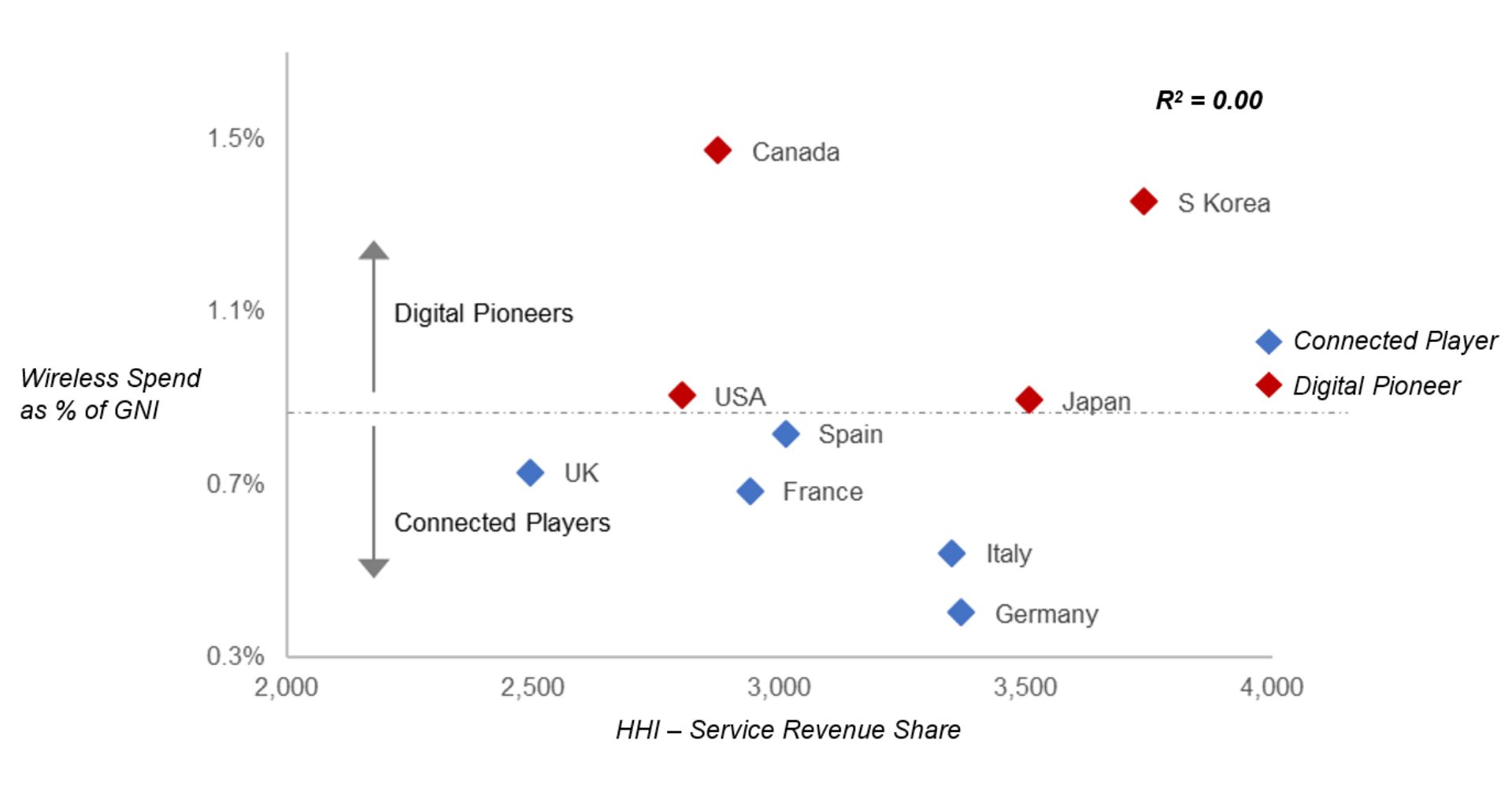

Market concentration vs. pricing: Telecom regulators across the globe are concerned that higher concentration in the wireless market will invariably lead to higher consumer prices. This relationship can easily be tested across these markets. To determine pricing, commonly used metrics such as ARPU, price/min or price/GB could be used. However, these metrics do not account for variations in the cost of living across these countries. By normalizing the wireless spend for gross national income per capital, we can make an apples-to-apples comparison. This analysis is shown in Figure 9 and it is apparent that no correlation whatsoever exists, with an R2 of 0.00. It is interesting to note that consumers in all European markets in the analysis spend a significantly lower share of income on wireless services. However, there might be a perverse explanation to this trend – wayward regulation, such as exorbitant fees for 3G licenses, requirements tying a specific network technology to a spectrum band and more recently, elements of the digital single market across EU has put operators in these markets in catch-up mode for the better part of two decades. Delayed deployment of 3G and 4G networks have delayed the widespread adoption of smartphones and associated applications which in turn has suppressed wireless spend.

Figure 9: Correlation of wireless service pricing with market concentration

According to the FCC’s own assessment of mobile broadband availability, speed, and price for the countries in this analysis, as shown in Figure 10, the U.S. is only behind the UK in terms of pricing for like-for-like product, as measured by the Mobile Hedonic Broadband Price Index (PPP).

Figure 10: Mobile hedonic broadband price indices (PPP)

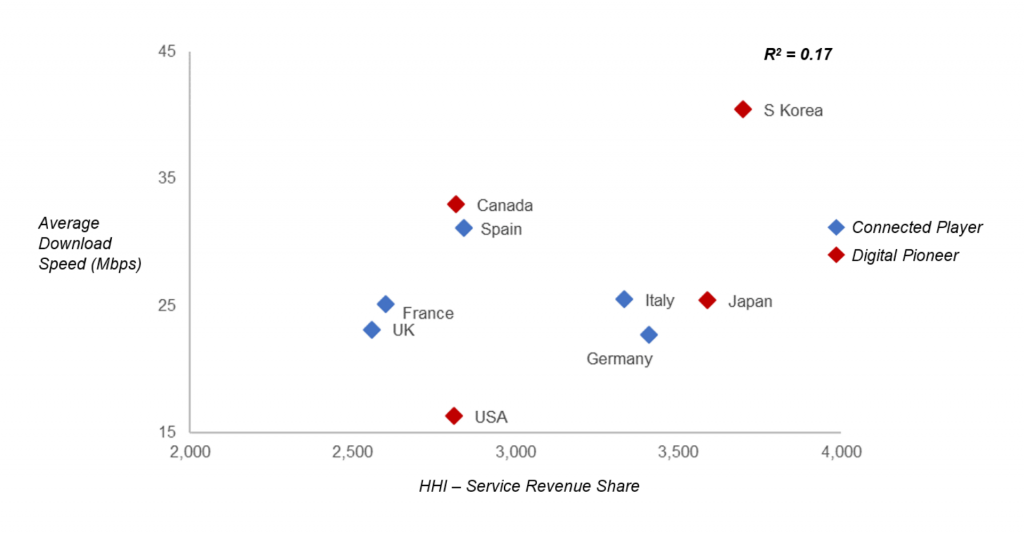

Note: Index includes adjustments for demographics and content quality

Market concentration vs. innovation and investment by operators: Telecom regulators across the major regions of the globe have long understood the benefits of leadership in each wireless generation. Furthermore, no one region has led the world in consecutive generations, with Europe leading in 2G, Japan in 3G and the U.S. in 4G. Smart policymaking is essential to give the U.S. a fighting chance to also lead with 5G technology development and deployment and this includes appropriate incentives for the industry to invest and innovate. Network speed is a key characteristic of wireless network performance. Though the markets in our analysis vary in terms of geographic spread, urban vs. rural population and overall population density, availability of high speed wireless connectivity and average speeds across the network are ways to assess levels of investment by operators. We leverage speed data from OpenSignal, an app with by far the largest panel of over 20M users that continuously logs network speed and availability data. Though some self-selection bias exists, the sample is large enough to be a fair indicator of both 4G LTE availability and average network speeds near large population centers.

Figure 11: Correlation of average 4G LTE network speeds with market concentration

Despite being the first in the world to rollout nationwide 4G LTE networks and smartphone penetration only behind S Korea and Japan, US operators have not increased investments commensurate with mobile data traffic growth to offer world leading network speeds. The lower speeds are also due in part to the recent switch to unlimited by all major wireless operators. S Korea and Canada, poster children for concentrated wireless service markets offer customers among the world’s best quality 4G LTE networks. Across markets, the correlation between the quality of 4G LTE networks (as measured by average download speeds) and market concentration is tenuous at best, and contrary to perceptions, higher market concentration seems to lead to better networks, though this relationship has a weak R2 of 0.17. Empirical data across markets suggests that there is no support to the argument that fewer competitors (as few as 3) and greater market concentration will lead to lower investments and innovation by market participants.

Conclusion

Our analysis suggests that the wireless services market is highly concentrated across the world, with HHI ranging between 2,500 and 3,700. The high fixed costs and scale driven business model, increasingly concentrated vendor landscape and constantly evolving technology landscape that require huge investments all drive this high level of market concentration. Across most markets, the pricing for wireless services has decreased at a rapid clip, and these prices are over 25% lower today in the U.S. compared to a decade ago. Among high-income countries, the U.S. wireless services market seems to be less concentrated than most now. Moreover, empirical data suggests that there is no perceptible impact of greater market concentration on the levels of operator investment and innovation. Additionally, among this group of countries, empirical data shows no correlation between market concentration and pricing, as measured by wireless spend as a percentage of GNI.

The FCC recently found the mobile wireless services market in the U.S. to have effective competition, despite the high HHI. They based their conclusion on favorable pricing trends as well as healthy investments in the market and innovation by service providers. However, in assessing the market impact of the proposed T Mobile-Sprint merger, we see that 2 segments, namely retail – prepaid and wholesale become significantly more concentrated. Based on this analysis, horizontal merger assessment guidelines issued by the DoJ and FTC, and past precedence, we expect the regulators to challenge the combination.

While it is nearly impossible to predict the outcome of the review, given the significant increase in overall market concentration and especially so for two market segments, even if approved, we believe a set of conditions could be imposed on the merging entities. Some of the potential conditions include:

- Enhanced coverage obligations, especially in rural areas

- Affordable pricing plans or cap on price increases for an extended period

- Competitive wholesale network offering

- Mandatory participation in future spectrum auctions

- Divestiture of spectrum and / or entry of a new player (à la French low-cost provider Iliad’s entry in the Italian market as a pre-condition to Wind and Three Italia’s merger approval)

- Divestiture of prepaid brand(s)

As noted at the outset, any of the several regulatory bodies could challenge the merger proposal or place onerous conditions for approval. The stakes are high for consumers, wireless value chain participants and the country’s global competitive position as the industry begins the transition to 5G and we hope the regulators are thoughtful and forward-looking and enable America to retain its wireless leadership.