Client Situation

A mid-market PE firm made a growth capital investment in a provider of workplace communication software that powers digital signage in the corporate workplace. The deal team believed significant opportunity existed to scale the platform via M&A and to expand the business across end markets and geographies. Within 3 months, the PE firm completed the acquisition of a similarly sized digital signage business focused on a niche vertical. In this context, the PE firm and the management team had questions regarding strategic priorities, targets as well as team alignment on next steps to deliver these priorities.

3HA Approach

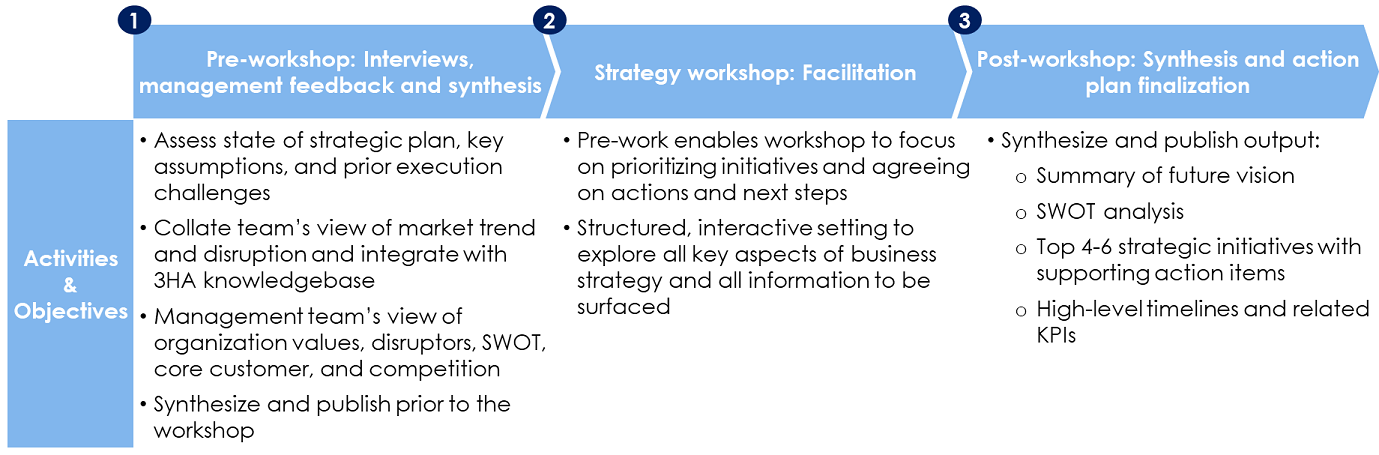

We engaged with the deal team and the management teams to facilitate a strategy workshop and synthesize the go-forward plan for the team.

Figure 1

Outcomes

As an outcome of this exercise, the management team and deal team aligned on:

- 3- year vision: Targets for equity value, revenue, EBITDA and number and size of add-on acquisitions

- Target customer: Defined target customer and identified their needs across multiple dimensions (ways to connect, features and benefits / needs and expectations, customer experience, customer economics)

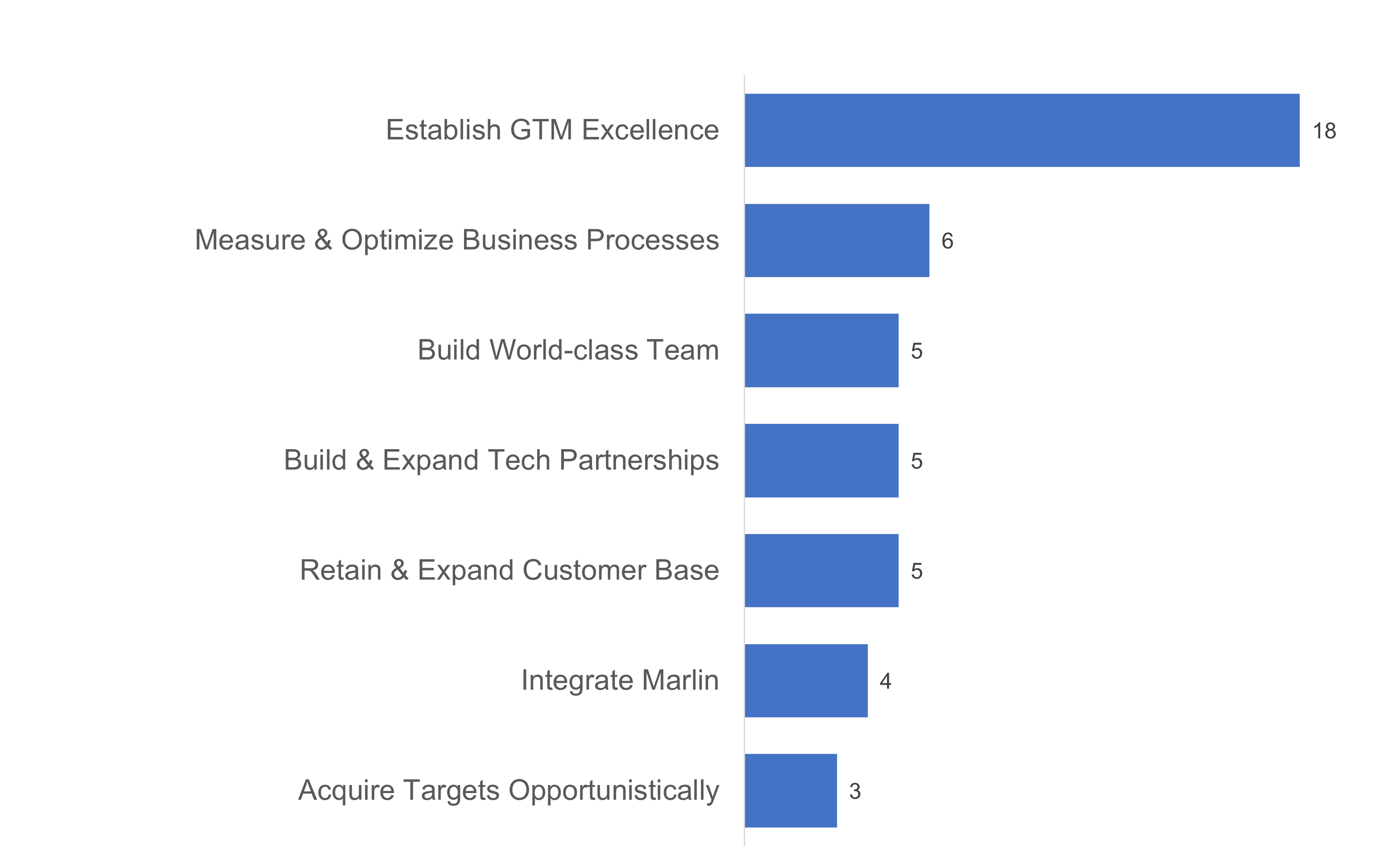

- Strategic plan: 7 strategic initiatives and 46 action items identified

Figure 2: Key strategic initiatives (Number of action items)