Client Situation

A micro-cap telecom infrastructure OEM client had suffered 4 consecutive years of declining revenues and multiple leadership changes. The 3HA team was brought in to review the strategy of record, map the market, validate the alignment of strategy to growing profit pools and make targeted recommendations for refinements and potential course corrections to the strategy of record to deliver sustainable and profitable growth. The company’s product portfolio was weak in one of the key growth areas identified. To augment the product portfolio, an inorganic growth strategy was developed and this diligence was an outcome of that effort.

3HA Approach

3HA employed a quick and focused research effort to:

- Determine the addressable fiber & connectivity market size and growth outlook

- Assess target company’s positioning and competitive landscape

Findings And Recommendations

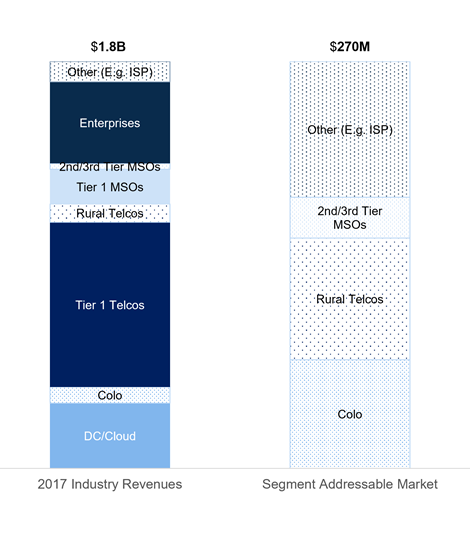

Leveraging the firm’s knowledgebase, exhaustive secondary research, and a focused set of expert interviews, 3HA was able to determine the key growth drivers, granular market segmentation and product categorization. Based on our assessment of each market segment’s need for the unique set of products brought to market by the target and the likelihood of winning, we were able to determine the segment addressable market. A detailed analysis of the last-mile fiber project bill of materials helped determine the product addressable market given the target’s current and in-development product portfolio.

Figure: Addressable market sizing

Sources: Network Telecom Information Research Institute, Expert Interviews, 3HA Research & Analysis

Outcomes

The engagement allowed the client to better assess the growth potential of the target’s product portfolio and how it fit within the client’s existing portfolio and R&D plans and helped them refine their investment thesis.