Xiaomi’s IPO might still be priced too rich

Key takeaways:

- Xiaomi priced its Hong Kong IPO at HK$17 valuing the company at $54B, roughly half the original target.

- Xiaomi had a dream run in 2017, breaking into new markets and regaining it’s footing in the home market of China.

- The smartphone market is maturing and for the first time ever declined in 2017 and further share gains in the hyper-competitive market will be challenging.

- Restricted access or outright censorship of Google and Apple services in China enabled Xiaomi to develop a services business, but unlikely can replicate this in other markets.

- Using Apple as a benchmark and even assuming lofty growth across Xiaomi’s business segments through 2019 only yields an enterprise value of $33B.

The hype

“We are more than a hardware company. We are an innovation-driven internet company.”

Lei Jun, Founder, Chairman and CEO of Xiaomi

“We are more than a hardware company. We are an innovation-driven internet company.”

Lei Jun, Founder, Chairman and CEO of Xiaomi

Thus started Xiaomi’s filing for an IPO in the 1st week of May 2018. Bankers had over the previous several weeks floated the idea that Xiaomi could raise $10B at a valuation of $100B. This valuation was largely predicated on investors buying the premise that Xiaomi was much more than a producer of affordable, yet nominally profitable smartphones and connected devices. Who doesn’t want a connected rice cooker in their kitchen, so they can be bombarded with ads from different brands of rice?

Is Xiaomi more than a hardware company?

In 2017, 70% of Xiaomi’s revenues came from mostly low-end smartphones with an average selling price (ASP) of $135 and a paltry gross margin of 13%. Another 20% of revenues came from IoT and lifestyle products with even more anemic gross margins of 8%. Xiaomi has embraced an open innovation model to bring 100’s of these connected devices to market in collaboration with approx. 90 ecosystem partners. This model offers Xiaomi both time-to-market and fixed cost benefits. In 2017, Xiaomi had $1.5B of services revenue, primarily from advertising and mobile gaming revenue share agreements and this comprised less than 9% of total revenues. Xiaomi had 171M monthly active users (MAUs) on the MIUI platform at the end of 2017 and though the company did not offer a breakdown of service revenues across geographies, management has acknowledged that growing service revenues in international markets is a priority. Xiaomi’s ability to accelerate growth of MAUs and at the same time average service revenue per MAU will largely determine the outlook for the stock post IPO.

Flawless execution in 2017 – is this repeatable?

Flash sales are an effective marketing strategy helping create buzz around the brand, giving buyers an air of exclusivity and enabled Xiaomi to enter new markets without the time and costs traditional approaches entail. In addition to finishing 2017 as the #4 smartphone vendor in it’s home market of China, Xiaomi was a top-5 smartphone vendor in 15 markets including the #1 position in the burgeoning Indian market. International growth contributed to 50% of 2017 revenue growth.

However, Xiaomi had to resort to traditional methods to expand distribution and grew Mi Home retail stores in China 5x in 2017 and distribution to support offline expansion with distributor count growing 270% YoY to 1,100+. This approach replicates the strategy of every other smartphone vendor, increases sales and marketing expenses and exposes Xiaomi to the vagaries of the channel. One must question if “New Retail” touted by Xiaomi will increasingly look like Old Retail.

While Xiaomi’s unique model of engaging with users on product development has created an above average loyalty, the low-end of the smartphone market in general sees low levels of customer loyalty. Witness Xiaomi’s own stumbles in 2016 as well as the revolving door for leaders in this segment with multiple Android based smartphone brands such as Huawei , Oppo, Vivo, Honor, Xiaomi and Lenovo trading positions since 2015. Also, the road to smartphone glory is littered with the carcass of numerous global vendors including Nokia, Motorola, Blackberry, HTC, and Sony Ericsson.

What is the market outlook?

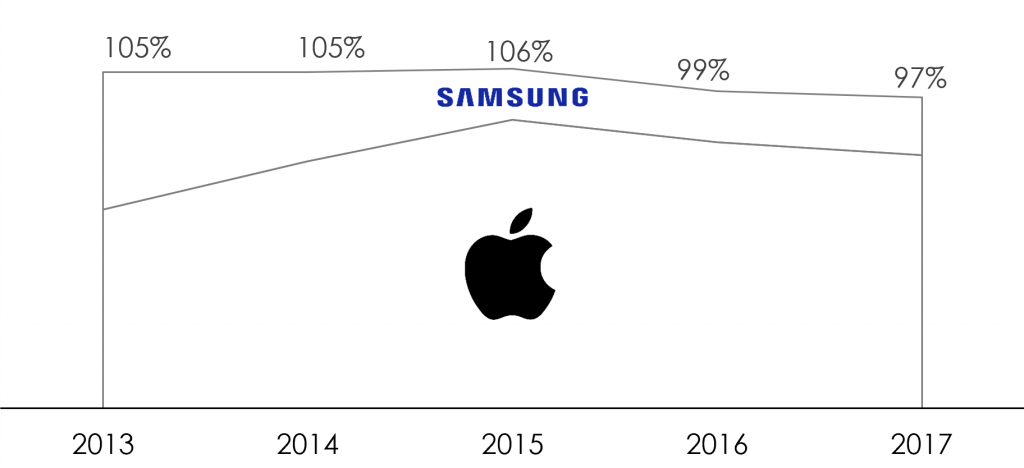

Smartphones have grown smartly over the last several years, but this has also led to high penetration in most major markets. According to Pew Research, India and Indonesia are the only two markets with less than 50% penetration among the top-7 markets. Additionally, with the innovation in smartphones slowing down the replacement cycles are slowing down and according to Kantar is approaching two years across most major markets. The smartphone market is maturing and for the first time ever, declined in 2017. Increasing competitive intensity in a slow growth market is likely to make sustained growth a challenge. Furthermore, the smartphone profit pool has historically been dominated by two players with Apple and Samsung garnering nearly all the industry’s profits. Figure 1 shows this trend between 2013 and 2017.

Figure 1: Global smartphone profit pool by smartphone vendor

Sources: Canaccord Genuity, 3HA Research & Analysis

So, notwithstanding Xiaomi’s gimmicky pledge of capping hardware net profit margins at 5%, they are quite unlikely to sustainably even achieve that.

The IoT market is large and expected to grow robustly and will dwarf the smartphone market. However, most of the revenues are driven by Industrial IoT (IIoT) and Xiaomi does not participate in this market. This said, according to IDC, the consumer IoT market is the 4th largest industry segment and expected to grow fastest at 21% CAGR through 2021. Moreover, historically there has been minimal uptake of recurring revenue services within consumer segment. Furthermore, this thousands of SKUs and product categories drive extreme operational complexity and according to Xiaomi’s own filing, the top-5 vendors combined have less than 5% installed base share globally. These dynamics will make it challenging for Xiaomi to grow high-margin revenues.

The Internet Services opportunity is large and continues to grow rapidly and according to iResearch will reach $2.6T by 2022. Internet retail, online advertising and online gaming are expected to be the three largest categories, and each has established and deep-pocketed incumbents in every single major geography. Xiaomi’s annual services revenue per MAU doubled between 2015 and 2017 to $8.9 / MAU. This was aided by the fact that the Android app store and Google services are limited or non-existent in China. As Xiaomi looks to international markets for future growth where these services are not restricted and have been widely adopted, it is likely to face stiffer competition for service revenues.

Should Xiaomi be valued like an Internet services company?

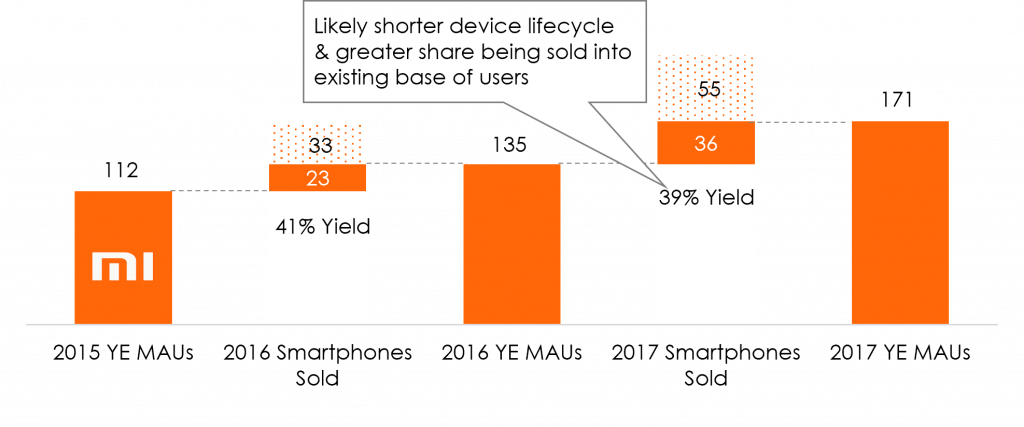

To answer this question, one must dissect both the past performance and outlook on two dimensions – the MAU growth (Q, Quantity in P x Q) and service revenue / MAU (P, Price). Taking end of year monthly active users reported by Xiaomi and the annual smartphone shipments, we determine Xiaomi’s yield at approx. 40% on new smartphone sales. This is shown in Figure 2. This compares poorly with the 54% yield for Apple during this time, a vendor with a much more established user base. This is likely explained by shorter device lifecycles for Xiaomi and greater share of devices being sold into existing base of users. This key metric will determine the rate and pace of growth of MAUs for Xiaomi.

Figure 2: Xiaomi monthly active user (MAU) counts (millions) and yield on smartphone shipments

Sources: Xiaomi, 3HA Research & Analysis

In 2017, International markets, contributed to over 50% of Xiaomi’s smartphone unit growth and markets such as India, Indonesia and Russia will be a major focus for future growth. Consumers in these markets have significantly lower spending power than China. For example, the monthly wireless ARPU in India and Indonesia is $2.8 and $3.1 respectively vs. approx. $9 in China. This is likely to not only depress the ASP of smartphones sold, but also limit the service revenue per active user.

How does Xiaomi compare to Apple?

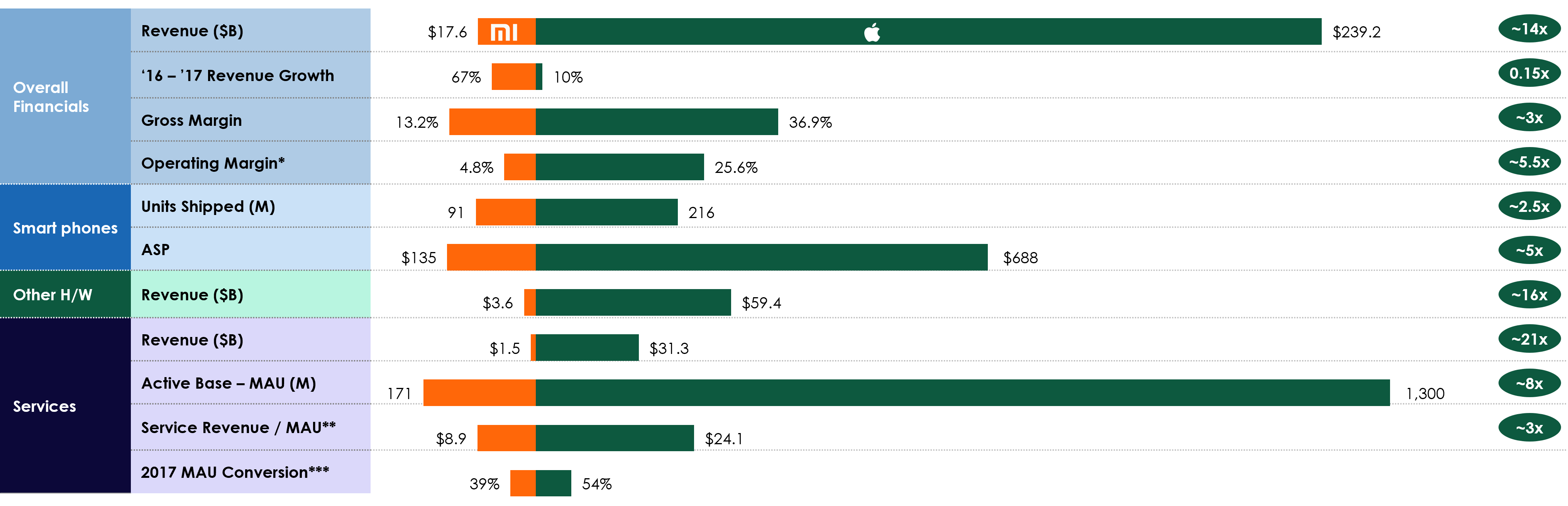

Apple is the appropriate benchmark for companies like Xiaomi not only because their core business is also smartphones, but also because their revenue diversity is enviable and is exactly what Xiaomi is trying to emulate. In CY 2017, Apple derived 25% of total revenues from hardware other than smartphones (iPad, wearables etc.) and service revenues exceeded $31B (13%+ of total revenues) with an annual service revenue / MAU of $24.

On key revenue dimensions, Xiaomi is 15-20 times smaller and in 2017, profitability was 3-5.5x lesser than Apple. This said, Xiaomi is expected to grow significantly faster, but business model and regional skew will likely keep profits relatively depressed. Figure 3 compares Xiaomi and Apple on key 2017 metrics.

Figure 3: Xiaomi Vs. Apple comparison (2017 metrics)

Sources: Apple, Xiaomi, 3HA Research & Analysis

What does this mean for Xiaomi enterprise value?

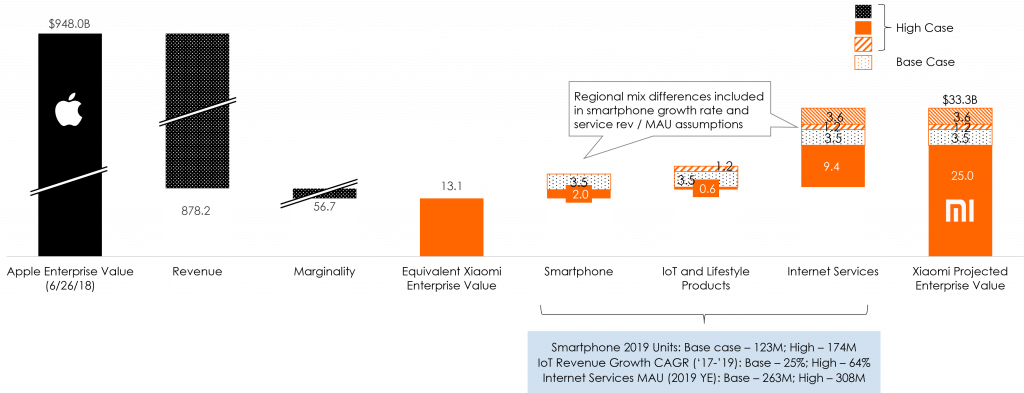

Indexing Xiaomi to Apple’s enterprise value would be a good starting point. In late June 2018, Apple had an enterprise value of $948B. Adjusting for revenue scale and weaker marginality would yield an enterprise value of $13B for Xiaomi. But this would not account for the significantly faster growth rates expected for Xiaomi and potential expansion in marginality, especially from a rapidly growing services business.

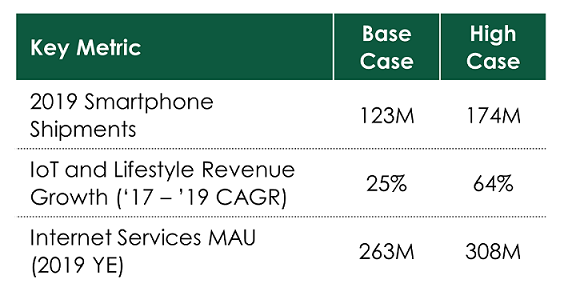

We estimate 2019 performance for Xiaomi on key metrics and model both a base case and a high case assuming the company can replicate it’s 2017 execution both in 2018 and 2019. This is shown in Figure 4.

Figure 4: 2019 projections for Xiaomi’s key metrics

Sources: Apple, Xiaomi, 3HA Research & Analysis

Accounting for business mix changes driven by higher growth rates for Internet services and IoT and Lifestyle products and with reasonable assumptions for margin expansion for each of the business, we project a base case enterprise value of $25B. Using the high case assumptions yields an enterprise value of approx. $33B. This build-up is shown in Figure 5. This is a far cry from the $100B hype earlier this year and even the $54B implied valuation based on the $4.7B raised by Xiaomi and some existing investors after pricing a Hong Kong IPO at the low end of a marketed range.

Figure 5: Xiaomi’s enterprise value build-up based on 2019 projections

Xiaomi operating margin adjusted for reported non-operating gains and losses

Sources: Apple, Xiaomi, IDC, iResearch, Stock Analysis on Net, 3HA Research and Analysis

So, what’s next?

There are still some unknowns in the IPO process, for instance Xiaomi’s plan to raise funds from mainland Chinese investors. However, it is already clear that institutional investors have not bought into the hype and time will tell if retail investors are equally skeptical of the company’s hype.